Unlock Chime+

for free with

direct deposit.

Higher savings and more banking tools for financial progress. Get even more of Chime, plus exclusive deals, with qualifying direct deposits.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC

Privacy Notice ›

Say hello to even more online banking benefits.

Chime+ gives you access to even more of our products, and it’s free when you set up a qualifying direct deposit.

No monthly fees

No overdraft fees. No minimum balance. No foreign transaction fees.

Fee-free ATMs

47,000+ fee-free ATMs at stores you love, like Walgreens®, CVS®, 7-Eleven®, and Circle K®.

Chime Card™

Increase your FICO® Score 30 points on average with on-time payments and score 1.5% cash back everyday.

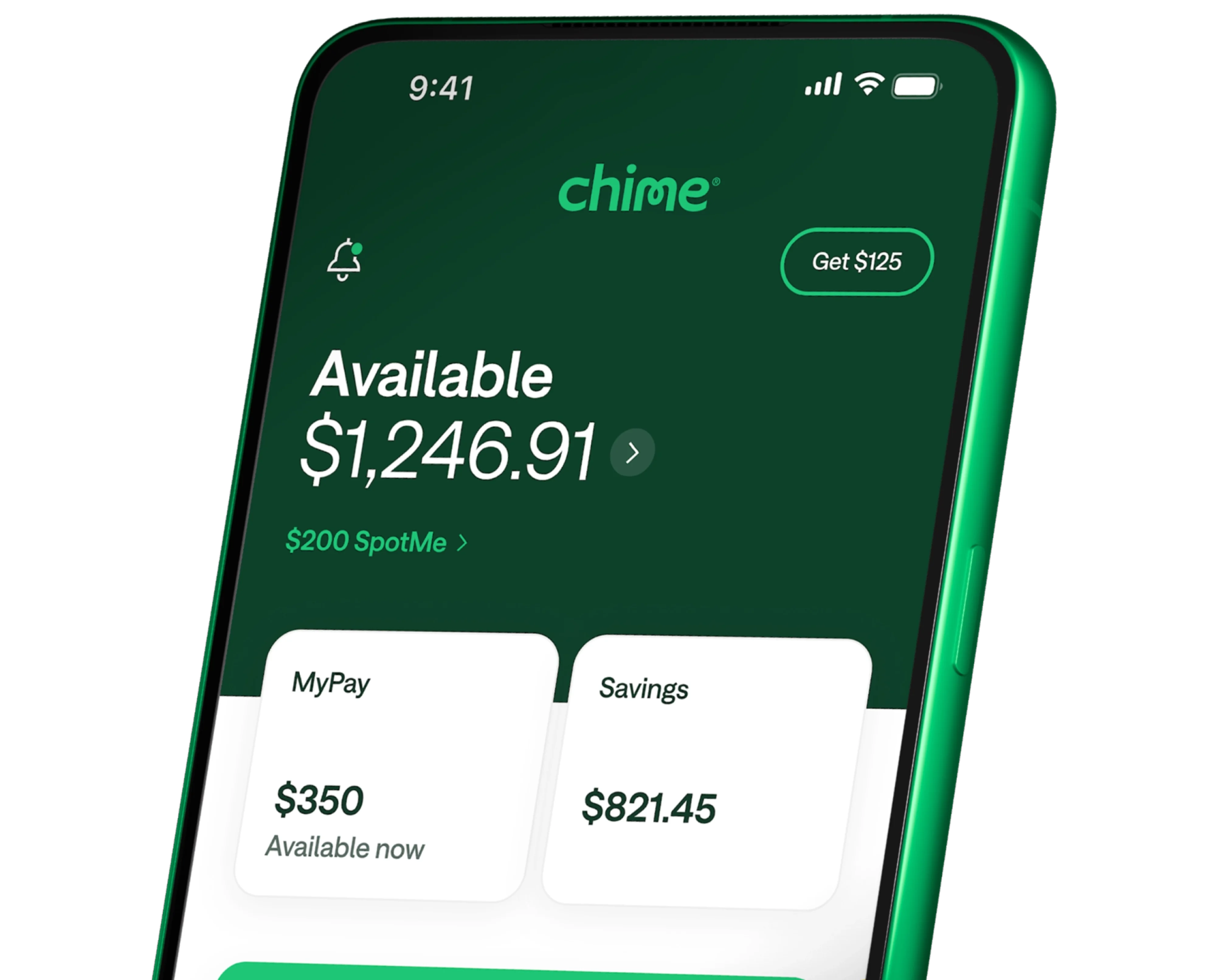

SpotMe®

Fee-free overdraft up to $200 that can really save the day.

MyPay®

Get up to $500 of your pay before payday.

High-Yield Savings

Get a plussed-up 3.50% APY on your savings.

Chime Deals®

Get cash back on everyday purchases.

Priority Support

24/7 support, with a real human.

Industry-Recognized Security

With real-time alerts and Visa® Zero Liability, you’re covered if your card gets lost, stolen, or used for fraud.

See everything that you get with Chime+.

Level up your online banking even more with Chime+. More cashback rewards, more savings interest, more options.

Features | ||

|---|---|---|

1.5% Cash back | ||

MyPay® | ||

SpotMe® | ||

Savings APY | 3.50% | 1.00% |

Chime Card™ | ||

24/7 support | Priority | |

Chime Deals® | Exclusive | |

Fee-free ATMs |

How to get Chime+

It all starts with direct deposit.

Move your paycheck to Chime (yep, that’s what direct deposit means). Then the magic happens...

Chime+ made me feel special and that they cared about me. What surprised me was the high APY for the Savings Account. It is higher than a lot of well known banks.

Delilah H.

Chime+ has really helped out with my financial situation. I recommend people get Chime+ --the perks with gas and being able to get money in between pay checks has been a huge help to my family. Thanks Chime. 😄

Gwen F.

Wow Chime+ has been so awesome for me. First of all, being able to do the SpotMe option in Chime has saved me in a pinch several time! As we have been planning our wedding, I have been using the Credit Builder as much at possible for wedding purchases and that has made a huge difference for me and my family!

Torry B.

Real Members. Paid testimonials.

Have questions about Chime+?

How do I get Chime+?

To get Chime+, you need to receive a qualifying direct deposit of $200 or more within the preceding 34 days. Once your deposit is processed, your Chime+ status will activate automatically.

What happens if I lose Chime+?

If you stop receiving qualifying direct deposits, your account will revert to Chime status. Keep in mind you’ll still have access to many of Chime’s best features, like fee-free checking, and more. You can also get Chime+ back by direct depositing $200 or more within the preceding 34 days.

Is Chime+ free?

Yes! Chime+ status is free. There are no membership fees and no maintenance fees to access Chime+.

To qualify, you need to receive a qualifying direct deposit of $200 or more within the preceding 34 days. Once this deposit is received, you’ll automatically get Chime+.

I already have an ongoing direct deposit at Chime. What changed?

If you already direct deposit $200 or more every 34 days, you’ll automatically get access to Chime+! Please keep in mind that if you’ve already enrolled in SpotMe® or MyPay®, your SpotMe limits and MyPay Available now amounts won’t change due to the addition of Chime+.